VAT Return - UAE

What is a tax return?

A tax return is a document containing a summary of all of the sales and purchases you made during a particular tax period. This includes imports, exports, and exempt supplies, along with the VAT paid or collected on every transaction. This document must be generated based on your invoices and filed through the FTA e-portal.

Every registered tax payer in the UAE is required to generate and file a VAT return once every tax period. The tax period is either a month or a quarter (3 months) depending on the prescriptions given by the FTA on your VAT certificate.

Important Filing Dates

The last day to file any VAT return, be it monthly or quarterly, is the 28th day of the month following the end of the VAT return period. For instance, if you are filing a quarterly VAT return for the quarter that runs from February to April, then the last day to file this return would be the 28th of May.

Note: The first tax period for the year 2018 can vary from business to business (based on the individual instructions that each one of them receives from the FTA)

For instance, if your first tax period is between January 1, 2018 and Jan 31, 2018, then you will be required to file your VAT return for this period on or before February 28, 2018 (or the next business day if February 28 happens to be a public holiday/weekend).

There are some cases where, the first tax period for a business can be greater than 3 months. For example, if your first tax period is between January 1, 2018 and April 30, 2018, then you have to file your VAT return on or before May 28, 2018 (or the next business day if May 28 happens to be a public holiday/weekend).

Contents of the VAT Return

A typical VAT return contains two sections:

- The main section which captures the details of the taxpayer, sales, purchases, and net VAT due.

- The additional reporting requirements section, which applies only to certain businesses under specific conditions. This section contains fields related to the profit margin scheme, stock transfers, and VAT paid in other implementing states.

Now let’s look at both sections in detail.

Main

All details in the main section will be pre-populated with your data, including the form type, document locator, tax form filing type, and submission date.

-

Taxable Person Details: This section will capture your Tax Registration Number (TRN), your name in both English and Arabic, the registered address or place of residence of your business, the name of the tax agency, the TAN, the name of the tax agent, and the Tax Agent Approval Number (TAAN). These details will also be pre-populated based on your data.

-

VAT Return Period: This section will show the tax year, VAT return period (month or quarter), and the VAT return period reference number. The return period reference number allows you to recover tax at the end of the tax year based on adjustments you’ve made during the year.

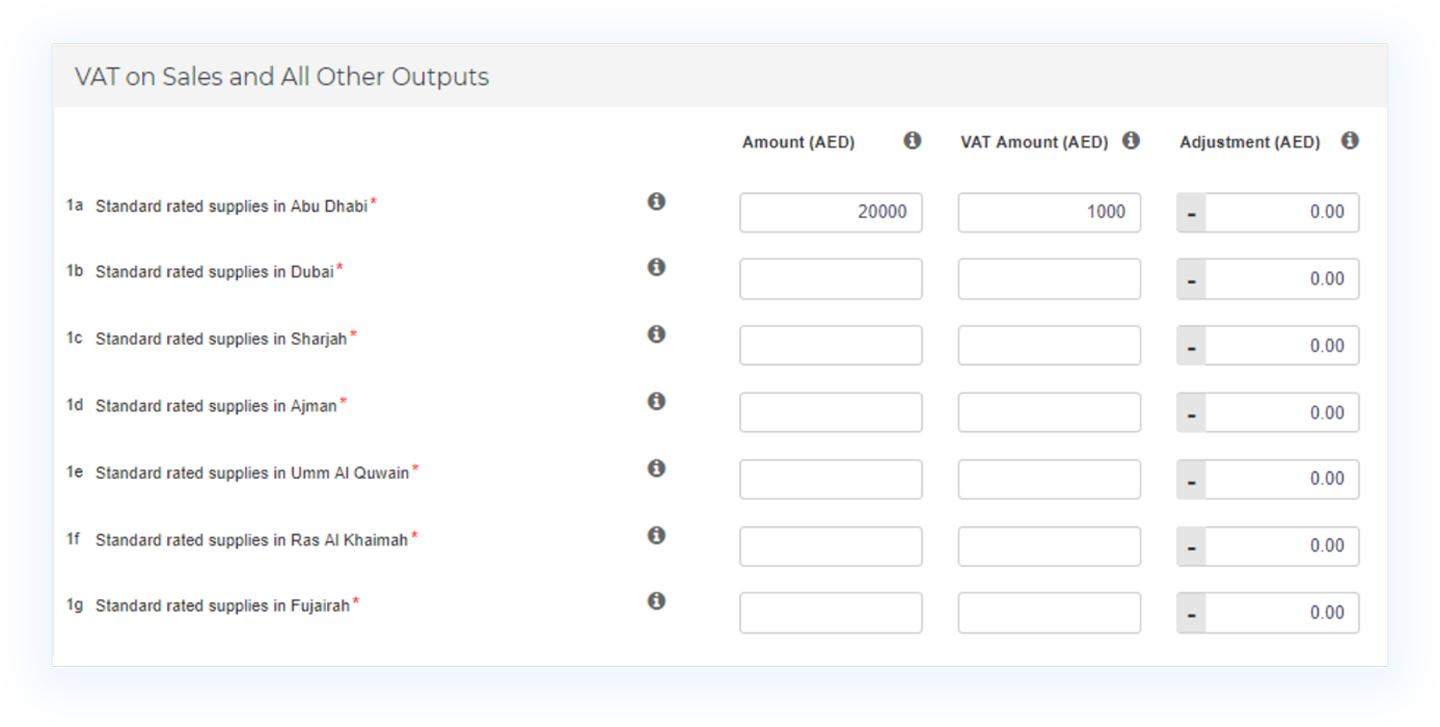

VAT on Sales and all other Outputs

This series of sections capture the details of all sales and supplies you made during the tax period. The information under this section is organized in tables showing the following three values:

- The total transaction Amount (AED) shown on the invoice (including any increase or decrease in value due to debit or credit notes and corrections from previous tax periods)

- The VAT Amount (AED) collected (including any changes to the VAT collected due to changes in the taxable value captured in the previous value)

- Any Adjustments (AED) to output tax (or VAT collected) made during the earlier tax period.

This part of the return is divided into 9 sections.

Box 1 - Standard Rated Supplies: Captures the sale of all goods and services sold or supplied within the UAE with 5% VAT. There is a subsection for each emirate, in which you are required to capture the sales you have made to customers located there and the VAT collected from that emirate.

Box 1 should include the values of:

- The supply of goods and services subject to VAT at 5%

- Supplies of goods and services at a discounted rate

- Sales through vending machines

- Supplies of commercial property

- Inter-company sales

- Supplies made to staff

- The sale of business assets

- Deemed supplies

- Reimbursements of expenses from customers

- The full value of goods sold under the profit margin scheme (less any VAT calculated on the margin)

- Sales from non-resident persons who are registered for VAT purposes in the UAE, where the importer is not responsible for the calculation and settlement of the tax

- Supplies of goods located within Designated Zones where the goods are consumed within the Designated Zone

- Reductions in value due to credit notes issued

- Errors that you are allowed to correct for previous Tax Periods. This will apply where you have discovered an error where the payable tax is more or less than required by AED 10,000 or less, and you discovered the error in this tax period. If the tax value of the error you have discovered is more than AED 10,000 you should submit a voluntary disclosure in the Tax Period in which the error was found.

This box should not include:

- Sales of goods located within Designated Zones which are not consumed within the Designated Zones

- Out of scope supplies

- Zero-rated supplies, such as exports of goods or services outside the UAE, zero-rated educational services and zero-rated healthcare services

- Disbursements

Box 2 - Tax Refunds provided to Tourists under the Tax Refunds for Tourists Scheme: This section applies only to retailers who have provided tax refunds to tourists according to the tax refund laws under the tourist scheme. All amounts in this section should be negative and listed in AED.

Box 3 - Supplies subject to the reverse charge provisions: This section captures the value of services that you have imported from suppliers outside of the GCC (for which you are liable to pay VAT directly to the FTA).

Box 3 should include the values of:

- Import of services subject to 0% or 5% VAT

- Purchase of crude oil in order to resell them

- Service obtained from a legal firm that is not registered for VAT

- Purchase of gold and diamond in order to resell or manufacture goods with these as the primary components

- Purchase of goods that are not cleared via customs will also be listed here

Box 4 - Zero-rated supplies: This section captures the value of all the exports you made to non-GCC countries, and any other supplies of goods and services at 0% VAT. The amounts must be specified in AED.

Box 4 should include the values of:

- Export of goods and services outside the UAE

- Supply of certain educational services and related goods

- Supply of certain healthcare services. For example, preventive and basic healthcare services and related goods.

- Sale of precious metals bought for investment purposes

- Sale of crude oil and natural gas

Box 5 - Exempt Supplies: Captures the value of all supplies of goods and services that are outside the ambit of VAT (in other words, exempted from VAT)

Box 5 should include the values of:

- Domestic supply of certain financial services

- Sale or lease of residential buildings

- Sale of bare land

- Local passenger transport used for business purposes

Box 6 - Goods imported into the UAE: This section will be pre-populated based on your import declarations you have declared under your customs registration number which should be linked to your TRN.

Box 6 should include the values of:

- Goods that are imported into the UAE through UAE customs

- Goods that are imported by agents on behalf of an unregistered person

Box 7 - Adjustments and additions to goods imported into the UAE: This section can be used to make any needed corrections to the auto-populated information in box 6.

Box 8 - Totals: This will be calculated automatically based on the data in subsections 1-8.

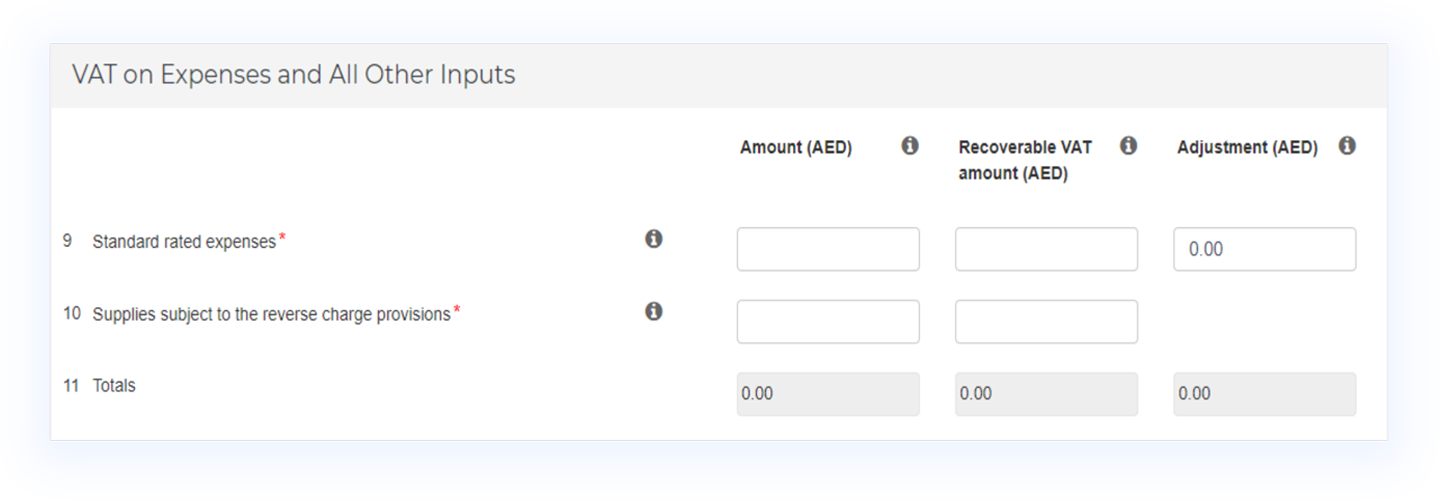

VAT on Expenses and all other Inputs

This series of sections captures all of your purchases and expenses during the tax period. The information is arranged in tables shows the following three values:

- The total purchase Amount (AED), based on your purchase invoices. This includes any increase or decrease in value due to debit or credit notes issued by your suppliers or corrections from previous tax periods.

- The Recoverable VAT Amount (AED) or amount of VAT refunds you can claim according to the VAT law.

- Any Adjustments (AED) made to your input tax (the amount of VAT you paid on purchases) made during earlier tax periods.

This part of the return is divided into 3 sections.

Box 9 - Standard-rated expenses: These boxes capture all of your purchases on which you paid 5% VAT. This includes any recoverable VAT that you paid for a purchase made in another GCC country that also implements VAT.

Box 9 should include the values of:

- Goods or services purchased for business purposes from VAT registered suppliers that were subject to VAT at 5%

- Goods or services which were purchased at a discount

- The total price that you have paid for the goods purchased, which you are selling under the profit margin scheme

- Goods or services purchased before your tax registration and for which you wish and are able to claim the tax incurred

- Reductions in value due to credit notes received from suppliers

- Errors that you are allowed to correct for previous Tax Periods

This box should not include:

- Wages and salaries

- Purchases that were purely for private or personal use

- Expenses where the input tax is specifically disallowed, such as entertainment costs

- Expenses which were incurred to make exempt or non-business supplies

- Exempt or zero-rated purchases

- Purchases of goods located within Designated Zones which were not consumed in the Designated Zone or subsequently imported into the UAE mainland

- Gifts or donations of money freely given for nothing in return

- Purchases from members of the same tax group

- Fines and penalty charges received

You should only use the Adjustments column for:

- Bad relief adjustments

- Input tax apportionment annual adjustments

- Capital Assets Scheme

Box 10 - Supplies subject to the reverse charge provisions: Captures the transaction amounts along with the VAT which was declared in boxes 3, 6 and 7, that can be recovered for imports and purchases subject to reverse charge mechanism. You should include the full net value of the supplies in the Amount column and only the recoverable VAT on those supplies in the Recoverable VAT amount column.

Box 10 should include the values of:

- Import of goods and services that are subject to 0% or 5% VAT under the reverse-charge mechanism and are eligible for input VAT recovery

- Domestic supplies subject to reverse-charge mechanism. For example, the purchase of crude oil for the purpose of reselling.

- Import of goods by agents on behalf of an unregistered person

Box 11 - Totals: This will be calculated automatically based on the data in subsections 10-11.

Net VAT due

This section will show the amount of VAT you owe to the government using the total output VAT payable minus the amount of VAT you can recover from your inputs.

This part of the return is divided into 4 sections.

Box 12 - Total value of due tax for the period: Box 12 calculates the total value of due tax for the tax period which is total value of output tax.

Box 13 - Total value of recoverable tax for the period: Box 13 calculates the total value of recoverable VAT for the period which is the total value of recoverable input tax.

Box 14 - Payable tax for the period: Box 14 calculates the total value of payable tax for the tax period by deducting the value in box 13 from the value in box 12.

Box 15 - Do you wish to request a refund for the above amount of reclaimable VAT? This is a yes or no question. Select yes if you wish to get your recoverable VAT refunded to you in cash. If you would rather offset your VAT payable instead, select no.

Additional Reporting Requirements

Profit Margin Scheme

This applies to vendors who sell secondhand goods and have applied for the profit margin scheme, in which inputs are exempt from VAT and VAT is applicable only to the profit made during sales. Select yes if you have enrolled yourself under this scheme.

Transfer of own goods to other GCC implementing states

This section applies to businesses that transfer goods to their own branches in other GCC countries, such as Bahrain, Kuwait, Oman, Qatar or Saudi Arabia. Like the table above, this table captures the taxable value of the goods in three numbers: Amount (AED), VAT amount (AED) paid on inputs for which you recovered VAT, and any Adjustments (AED) made to the goods’ value.

Recoverable VAT paid in other GCC implementing states

This section is an extension of subsection 10. Here you are required to list any recoverable VAT you might have on purchases made in each GCC country individually.

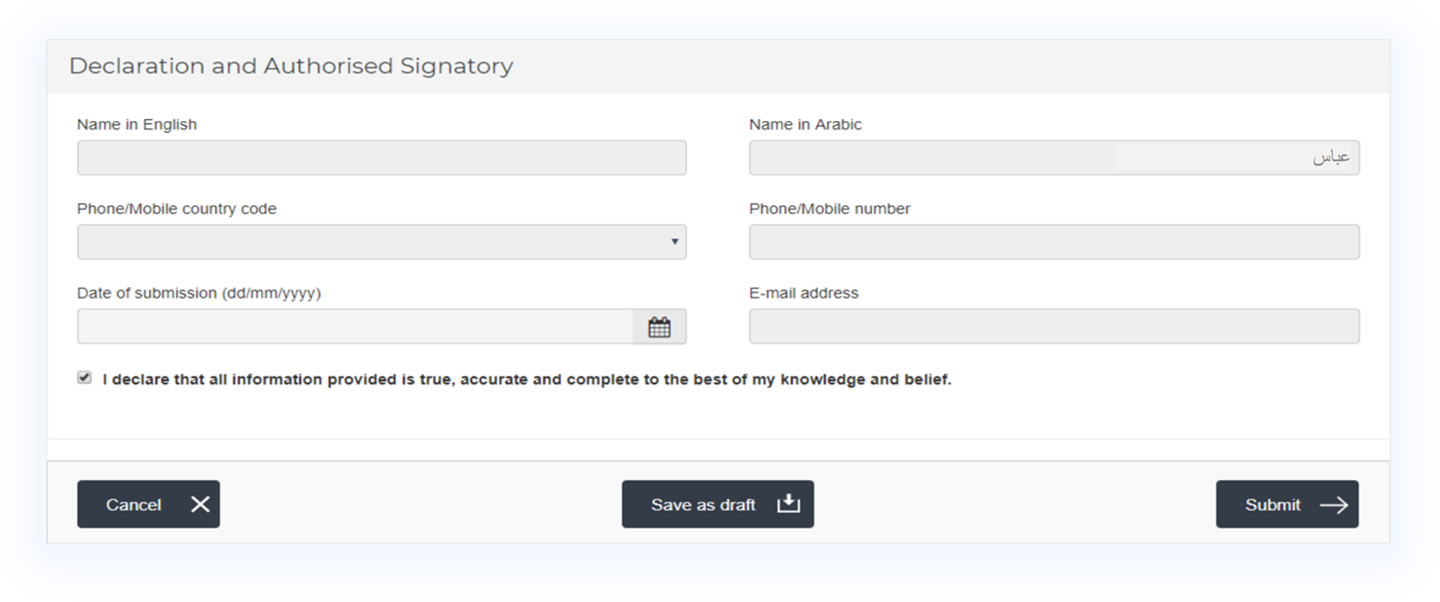

Declaration and Authorized Signatory

In this final section, you are required to vouch for the authenticity of the data that you have provided in the all the fields above, using the check box. All of your personal information will be auto-populated below the declaration.

All you need to know about VAT Filing for UAE

All you need to know about VAT Filing for UAE